|

NASGW SCOPE is an industry-leading data analytics platform built in partnership with shooting sports manufacturers, distributors and retailers. SCOPE DLX collects weekly shipment data from 20 leading distributors that represent demand from thousands of FFLs across the United States.

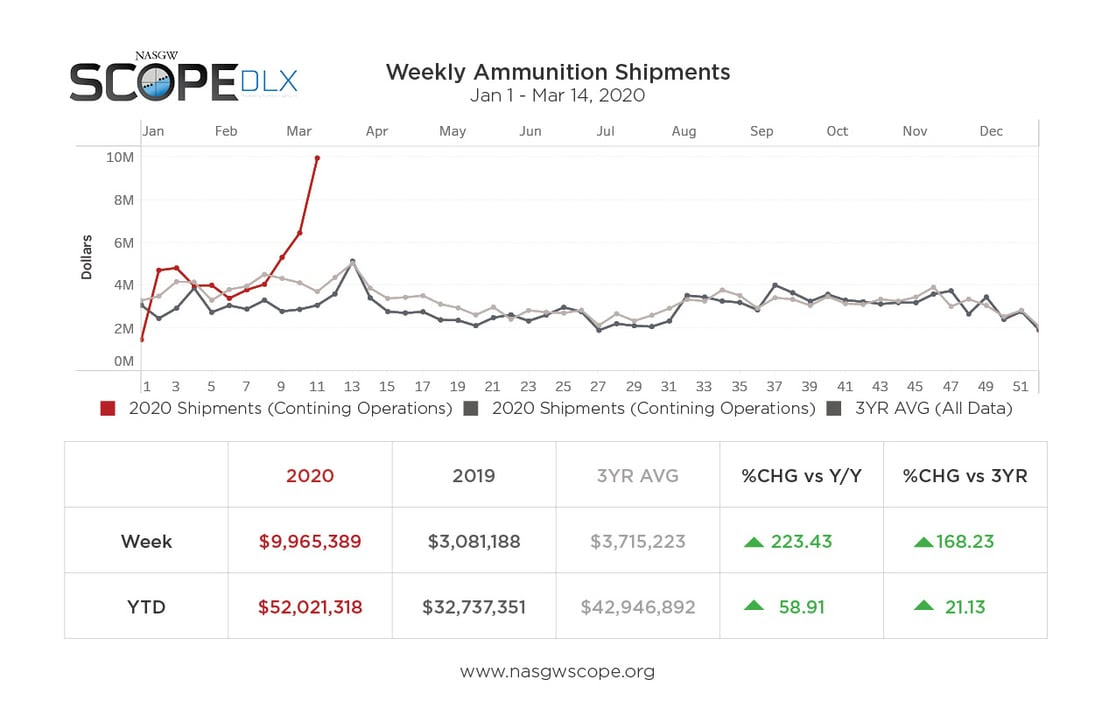

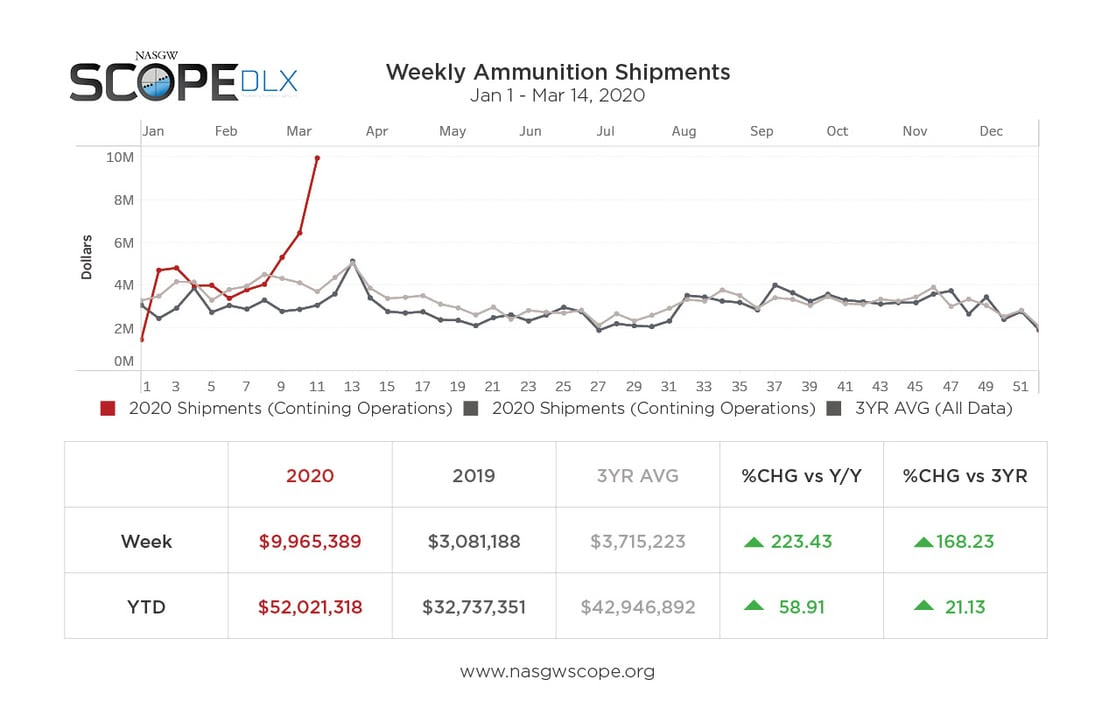

During the week ending March 14, distributors shipped close to $10 M representing a 168% bump above the 3YR AVG for the same week. In some states, SCOPE DLX shows up to a 600% growth in ammunition shipments. Overall, ammunition shipments are up 21% year-to-date (YTD).

"The COVID-19 virus is having an overwhelmingly negative impact on the entire country, but if there is any silver lining, it is the boost it's provided to our industry," said Kenyon Gleason, NASGW President. "SCOPE has allowed us to correlate trends with what is happening in the real world with trustworthy data and measure just how impactful this period is in comparison to previous years."

|

|

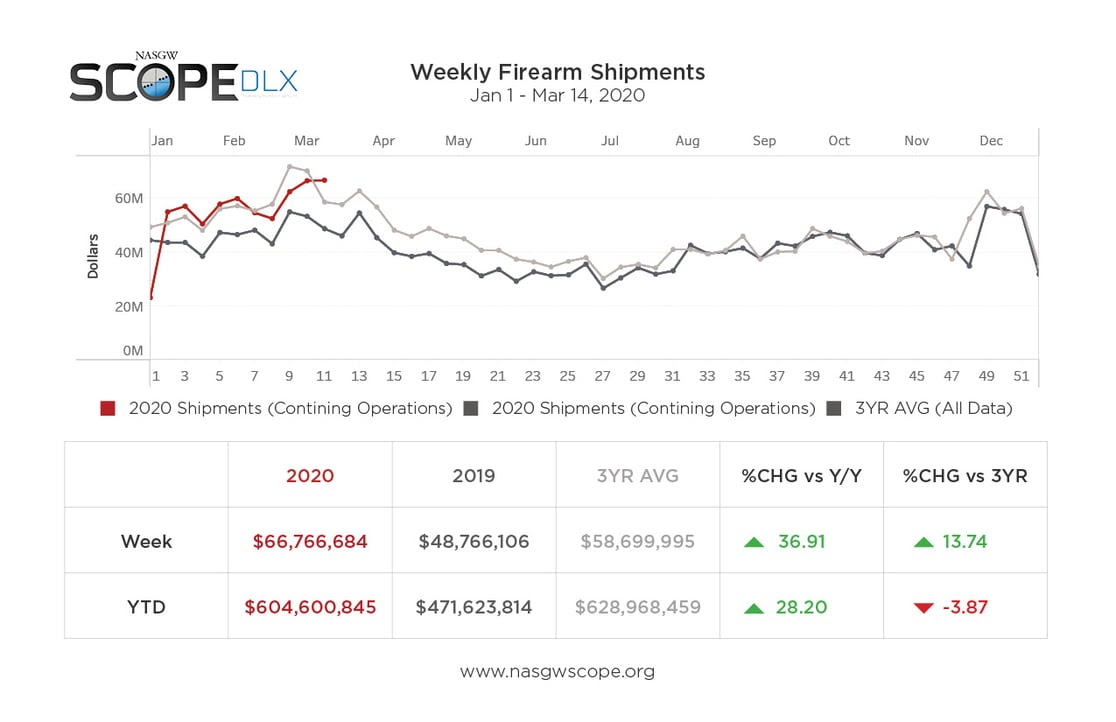

According to Chris Means, NASGW Director and President of Tactical Gear Distributors, ammunition was the first category to spike but firearms have been following.

"Firearms are driven by concealed carry handguns but we are seeing plenty of slow-selling full size pistols going too," says Means. "Price-point AR’s are also highly demanded and seeing increased sales of mid to higher priced AR’s increasing, but at a much slower pace. Firearms like Mossberg Shockwaves are in high demand."

Firearms shipments were up 13.74% compared to the 3YR AVG March 8-14. Despite the spike, year-to-date for firearms are still behind nearly 4%.

|

|

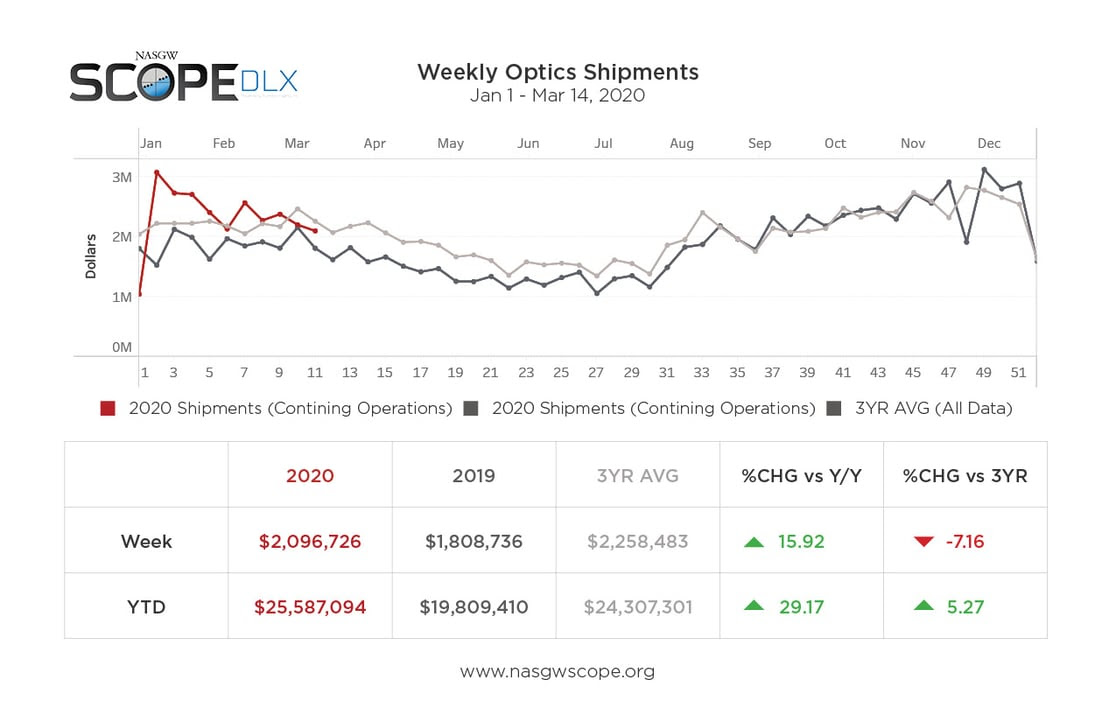

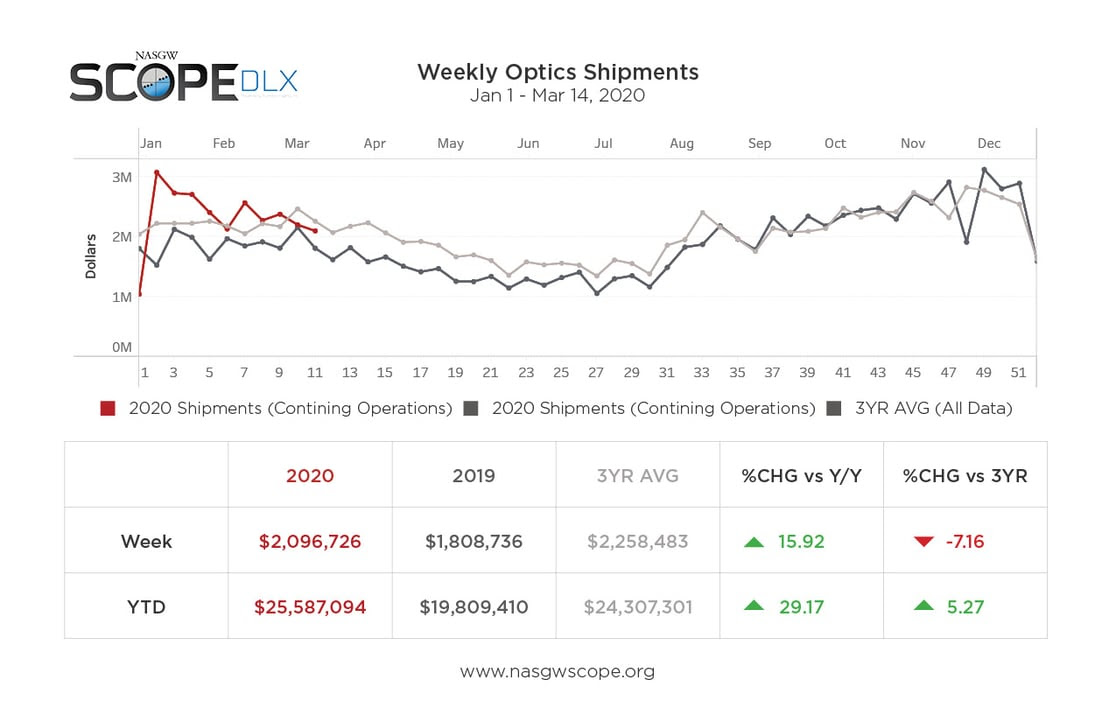

While firearms and ammunition have grown, optics and optics parts haven't felt the COVID-19 bump. Distributors shipments fell 7% below the 3YR AVG for the same week but are still up 5% YTD.

|

|

|

"SCOPE is an excellent way to measure the impact of events like COVID-19 on our industry," said Easton Kuboushek, NASGW Director of Data Programs. "The high-level trends tell an incredible story about the spike in demand, especially for ammunition. Our SCOPE partners are digging further into the trends by caliber and region to maximize the opportunity presented by this unfortunate pandemic."

NASGW SCOPE is an industry-owned, distributor led initiative designed to help shooting sports businesses collect and analyze data. NASGW recently announced the acquisition of CustomerLink Exchange (CLX) and the integration of point-of-sale data into the SCOPE platform. SCOPE CLX, powered by eComSystems, Inc, will soon be released with benefits for shooting industry manufacturers, distributors and retailers. To learn more about SCOPE and the upcoming launch of SCOPE CLX, visit nasgwscope.org or contact scope@nasgw.org to see how SCOPE data can benefit your business.

|

|

About NASGW

The National Association of Sporting Goods Wholesalers is comprised of wholesalers, manufacturers, independent sales reps, media and service providers - both national and international - all of whom are primarily focused on shooting sports equipment and accessories. As a trade association representing the business interests of its members, NASGW’s mission is to bring shooting sports buyers and sellers together. For more information about the NASGW, visit the association’s website at www.nasgw.org.

About SCOPE DLX Data

SCOPE DLX Distributor Partnerships & Data SampleDistributors in continuous operation for Firearms include: AmChar Wholesale, Bangers USA, Big Rock Sports, Bill Hicks & Co, Camfour-Hill Country, Chattanooga Shooting Supplies, Davidson’s Inc, Gun Accessory Supply, Gunarama Wholesale, Hicks Inc, Lipsey’s, Orion Wholesale, WL Baumler, Tactical Gear Distributors, Zanders Sporting Goods and Sports South.Sports South is not included in the ammunition or optics trend.

The 3-year Average includes shipment data from 2019, 2018 and 2017 from all distributors listed above plus four additional distributors no longer operating. These include: Green Supply, LM Burney, United Sporting Companies and Williams Shooter Supply.

|

|